Stock Research: Where Do I Start?

/Choose THREE companies in your industry on the basis of:

Low Risk (Conservative) – Does not fluctuate in the market, but still a good purchase for long term profit.

Medium Risk (Moderate) – Relatively inexpensive stock, fluctuates with market trends, no big news happening about the company. Trends have been slight changes but nothing drastic.

High Risk (Aggressive)-Fluctuates greatly in the market, there’s a lot of buzz about the company and the new products/ services which can cause high fluctuation. The growth has been tremendous in the last 5 years, and the trends have had large gaps, however, a great investment.

Compile a brief overview and description of the company. Talk about its products and services, and company size is important, as well as, insider trading. If many employees are investing, then they are confident about the growth of the company.

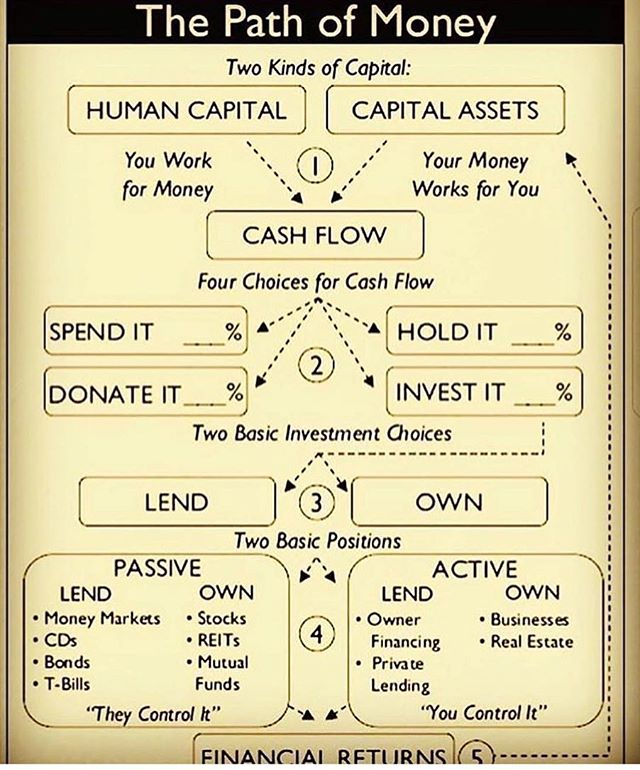

Financial Analysis –

Market Trends – its volatility and liquidity in the market.

Comparison to our stock to the industry and how much the industry is earning.

Earnings Per Share – (Net Income- Dividends on Preferred Stock)/ Average Shares Outstanding---the higher the EPS, the more money your shares of stock will be worth because investors are willing to pay more for higher profits.

Revenue – If revenue is increasing (look between a 3 month period to gauge whether the revenue is increasing or decreasing).

Return on Equity (ROE) - Average Shareholders Equity/ Net Profit ( 1 year) - Be sure to measure 2 years at least for comparison and trend purposes.

Earnings Forecasts – This is to ensure profitability on the company in the future.